Paying too much on your loan? Right Path Loans helps you refinance with better rates, flexible terms, and access to extra cash so you can save more and stress less. With a quick and hassle-free process, getting a better loan has never been easier.

Lower your monthly payments with better interest rates and flexible repayment terms, giving you more financial freedom.

Access extra cash from your vehicle or asset’s equity to use for personal needs, investments, or unexpected expenses.

Enjoy a quick approval process with minimal paperwork, making refinancing simple and stress-free.

Our Service

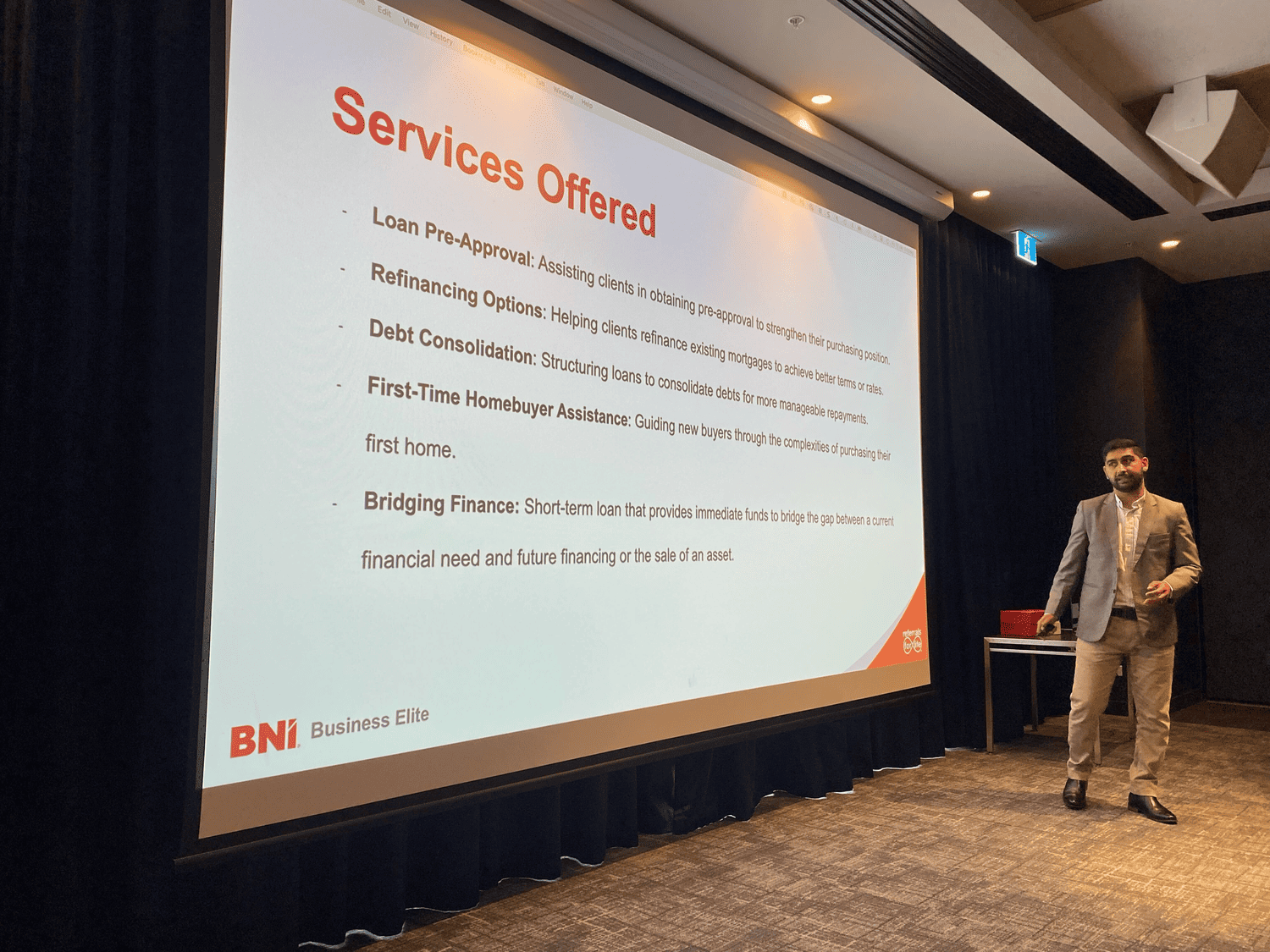

Pre-Approval: We’ll help you get pre-approved for a home loan so you can shop with confidence and know exactly how much you can afford to borrow.

Loan Comparison: With access to multiple lenders and loan products, we’ll help you compare your options and find the loan that best suits your needs.

First Home Owner Grants: We’ll assist you in navigating the various government grants and incentives available to first home buyers, helping you maximize your savings.

Negotiation: Our team will negotiate with lenders on your behalf to secure the best possible terms and interest rates for your home loan.

Support: From your initial consultation to settlement and beyond, we’ll provide ongoing support and guidance to ensure a smooth and stress-free experience.

Our Service

Refinance Your Car or Asset & Take Control of Your Finances

At Right Path Loans, we understand that finding the right mortgage solution is not just about numbers; it’s about realising dreams and securing futures.

Copyright © 2025 Right Path Loans – All Rights Reserved.

Pardeep Singh (Credit Representative Number 554113) and Kiaved Pty Ltd ABN 60 672 961 401 (Credit Representative Number 554114) are credit representatives of Purple

Circle Financial Services Pty Ltd ABN 21 611 305 170 Australian Credit Licence Number 486112